About Northrop Grumman Federal Credit Union

You can contact NGFCU Member Services at memberservices@ngfcu.us. For security purposes, please do not send account numbers or other personal information via standard email.

NGFCU offers branch service to members at sites in seven states. Members can also access branch service at hundreds of outlets nationwide through the CO-OP Shared Branch network. Hours vary by location. Please visit the locations page to find branch service near you.

You may send a fax anytime to 310-808-9697 or 310-808-9698.

To join NGFCU, submit our new member application form or visit one of our branch locations.

Membership is available to:

- Employees of NGFCU

- Employees of Northrop Grumman Corporation and its subsidiaries

- Employees of Metro, Los Angeles County

- Employees of Metrolink

- Retirees or annuitants from the above organizations

- Members of the Southern California Historical Aviation Foundation (SCHAF)

- Immediate family members of an NGFCU member, including the spouse of a family member who died within NGFCU membership eligibility

To join NGFCU, please submit our new member application form or visit one of our branch locations.

Account Questions

If your employer offers direct deposit, give the payroll department our credit union’s routing number, 322276088, and your account number.

You have several options for changing your address.

Branch – If you’re at a branch, a member service representative will help you change your address.

Online – Log in to NGFCU home banking and click on User Options in the top navigation bar. Choose Change Address in drop down menu and follow the prompts.

Mobile app – After using quick log in, click on the hamburger menu (three short lines) in the upper left corner of the screen and choose Settings. Enter your password. Choose Change Address. Make your changes and select Update in the upper right corner.

By mail – Members can use the address change form and mail it to the Credit Union.

To add a joint owner, members must complete an Additional Account Application with all the signers who will be on the account.

To remove a joint owner, the primary and any joint account holders must complete the joint owner removal form or the account can be closed and re-opened with different ownership. All CURRENT owners on the account must complete and sign the joint owner removal form. If the completion of the form is not witnessed by an NGFCU employee, the signatures must be notarized.

ATM Questions

Visit our Branches page to locate the closest ATM at an NGFCU branch or CO-OP Shared Branch.

Northrop Grumman Federal Credit Union does not impose a fee on an NGFCU ATM cash withdrawal when you use an NGFCU ATM card or an NGFCU Visa Debit card at an NGFCU ATM. NGFCU may impose a fee for withdrawals at ATMs not operated by NGFCU based on the member’s combined total shares and loan balance. Please see our Fee Schedule for details. Other card issuers, even some within the CO-OP Network, may charge a fee for using their cards to make cash withdrawals at ATMs other than their own ATMs. Check with your card issuer for details about their ATM usage fee policies.

No. There is no charge for a new ATM or Visa Debit card. However, there is an $8.00 fee for a replacement card after the third request.

The first $2,500 deposited into an ATM machine will be made available immediately. Any funds in excess of the first $2,500 will not be available until the second business day after the deposit is made. In the event of an extended hold on funds beyond this, you will be sent additional information.

Certificate Questions

A certificate entitles the owner(s) to receive dividends on the deposit for a specified time at a specified dividend rate. It is similar in many ways to a bank’s certificate of deposit as you will earn more dividends than in a regular savings account. Like a certificate of deposit, if you close the certificate before its maturity date, you may pay a penalty.

Dividend rates on Certificates vary and are generally based on the length of the term and the balance when the certificate is opened.

Checking Questions

If your checks are lost or stolen, please contact NGFCU immediately to place a stop payment on the lost or stolen checks. Take any other necessary action to secure your account and begin any necessary dispute processes.

There are no fees or charges for a checking account. Members under 65 must purchase their checks. Members 65 and over receive one free order of checks each year.

Yes. This service automatically transfers funds from your NGFCU Personal Line of Credit, savings account or money market account with no transfer fee. The transfer is recorded on your monthly statement or you can login to NGFCU online banking anytime to check your account balances.

Yes. Check holds vary based on how the check is deposited. Up to $5,525 may be released immediately, but under certain circumstances holds on funds can be placed for a day and up to seven days. Please refer to our Truth In Savings disclosure for detailed information about holds on deposits.

Debit Card Questions

There is no fee for a new Visa Debit card. There is an $8.00 card replacement fee after the third request for a new card.

The terms “debit card” and “check card” mean the same thing. A debit card withdraws money from your checking account as a check does; therefore, it debits your account. It can also enable you to withdraw money at an ATM from your savings account. An NGFCU Visa debit card can be used to make purchases at any retail establishment that displays the VISA logo.

The cash withdrawal limit at an ATM is $1,000.00. At the point of sale, the withdrawal limit $5,500.00.

There is no charge for making a purchase with your VISA check card.

If your credit card is lost or stolen, call 800-754-4128 or 727-227-2447 outside the U.S.

Yes, your NGFCU Visa debit card is accepted in more than 200 countries. The international service assessment (ISA) fee is waived on your foreign transactions.

FICO Scores

FICO® Scores are numbers that summarize your credit risk. Scores are based on a snapshot of your credit file at a particular consumer reporting agency at a particular point in time, and help lenders evaluate your credit risk. FICO® Scores influence the credit that's available to you and the terms, such as interest rate, that lenders offer you.

Program participants will receive their FICO® Score 8 based on Experian updated on a quarterly basis, when available.

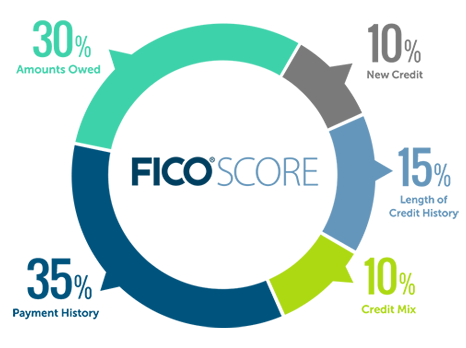

FICO® Scores are calculated from many different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how FICO® Scores are calculated.

No. The FICO® Score we provide to you will not impact your credit.

- You are a new account holder and your FICO® Score is not yet available

- Your credit history is too new

- Your account is a joint account

FICO® Scores are based on the credit information in a credit file with a particular consumer reporting agency (CRA) at the time the score is calculated. The information in your credit files is supplied by lenders, collection agencies and court records. Not all lenders report to all three major CRAs. The FICO® Score that we provide to you is based on data from your Experian report as of the 'pulled on date' shown with your score.

When a lender receives a FICO® Score, "key score factors" are also delivered, which explain the top factors from the information in the credit report that affected the score. The order in which FICO® Score factors are listed is important. The first indicates the area that most affected that particular FICO® Score and the second is the next significant area. Knowing these score factors can help you better understand your financial health over time. However, if you already have a high FICO® Score (usually in the mid-700s or higher), score factors are informative but, not as significant since they represent very marginal areas where your score was affected.

There are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, and different lenders may use different versions of FICO® Scores. In addition, FICO® Scores are based on credit file data from a particular consumer reporting agency, so differences in your credit files may create differences in your FICO® Scores. The FICO® Score 8 based on Experian data that is being made available to you through this program is the specific score that we use to manage your account. When reviewing a score, take note of the score date, consumer reporting agency credit file source, score type, and range for that particular score.

There are many reasons why a score may change. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency (CRA) at that time. So, as the information in your credit file at that CRA changes, FICO® Scores can also change. Review your key score factors, which explain what factors from your credit report most affected a score. Comparing key score factors from the two different time periods can help identify causes for a change in a FICO® Score. Keep in mind that certain events such as late payments or bankruptcy can lower FICO® Scores quickly.

Because your FICO® Score is based on the information in your credit report, it is important to make sure that the credit report information is accurate. You may get a free copy of your credit report annually. To request a copy of your credit report, please visit: http://www.annualcreditreport.com. Please note that your free credit report will not include your FICO® Score.

Reviewing your FICO® Scores can help you learn how lenders view your credit risk and allow you to better understand your financial health.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Northrop Grumman FCU and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Northrop Grumman FCU and Fair Isaac do not provide "credit repair" services or advice or assistance regarding "rebuilding" or "improving" your credit record, credit history or credit rating.

Financial Literacy Questions

Northrop Grumman Federal Credit Union offers Balance with free access to calculators, budget workbooks, and recorded webinars. You can visit any of the links below to view more information about Balance.

Schedule your free financial wellness checkup at https://ngfcu.balancepro.org/

Budget Resource Booklets

Budget Calculators

Recorded Financial Webinars

There are no credit union requirements for keeping financial records. However, you can access up to three years of your statements through online banking.

Cosigners lend their names and good credit histories to the maker. Should the maker die, lose a job, or otherwise fail to make payments, all responsibility for meeting the terms of the loan transfers to the cosigner. An often-overlooked aspect of cosigning a loan is the fact that the loan appears on both the maker's and cosigner's credit reports.

It might be tempting to view your 401(k) as a source of emergency funds, but before you dip into your retirement account for cash, explore alternatives.

To make this decision, calculate your monthly payments and your total net cost. When you compare these amounts, you can determine which option is right for you. Use our Auto Loan Calculator to estimate your monthly car payments. Then shop for the car that fits your budget.

To establish good credit, you need a steady work record and continued residence at the same address. If you do not have a checking account, open one and be careful not to bounce checks. Visit our Free Credit Report page to learn more about the benefits of establishing good credit.

General Product and Service Questions

Northrop Grumman Federal Credit Union (NGFCU) offers its members access to investment services provided by LPL Financial, member FINRA/SIPC. Visit our Invest page to learn more. Funds invested in this manner are not federally protected and are not insured by the National Credit Union Administration.

NGFCU offers Regular Savings, Money Market, Term Savings, IRAs, Education Savings, Holiday Club and Youth Accounts. Visit our Savings page to learn which savings account is best for you.

Yes. You can schedule fixed and variable bill payments on both a one-time and recurring basis through NGFCU Online or Mobile Banking. Funds are automatically transferred from your checking account to your designated payees, and a confirmation number is provided for each transaction.

Checks can be reordered through Online Banking or by calling our office at 800-633-2848 anytime.

NGFCU offers Online Banking, Mobile Banking, and Wire Transfers services.

Yes. Online Banking with Northrop Grumman Federal Credit Union is a fast, easy and secure way to manage your finances. Check your balances, transfer funds, pay bills and more—anytime, anywhere.

Loan and Credit Questions

No, anyone can apply for a loan with the Credit Union. However, the applicant must become a member in order for the loan to be funded.

You can make loan payments over the phone, through online banking, the mobile app, in-branch and by mail.

Because the federal government requires that each of the three national credit-reporting agencies—Experian, Equifax, and TransUnion—gives you a free credit report every year, consider staggering the receipt of each of your credit reports. That way, you'll get a continuous picture of how your credit picture looks, because the three bureaus feed each other the latest information. You’ll also be able to clean up errors as you find them (because errors can drag down a credit score) and you’ll also keep an eye on identity theft.

The federal government requires that each of the three national credit-reporting agencies—Experian, Equifax, and TransUnion—gives you a free credit report every year. Do not contact the individual credit-reporting agencies.

You can request a free copy of your credit report through NGFCU’s relationship with Balance – a non-profit dedicated to helping people and families achieve their financial dreams. You can also visit AnnualCreditReport.com. Consumers should be aware that there are many sites out there that claim to offer “free” credit reports but often charge you for another product if you accept the report.

A signature loan is a loan without material collateral such as a car or home. The maximum amount you can borrow is $40,000. You can use this loan for just about any purpose. Just submit our secure Online Loan Application to set up a Personal Signature Loan.

No, the Credit Union does not offer business loans

Getting pre-approved is a simple and important first step in the home-buying process. A mortgage preapproval validates your ability to back up your offer to buy a home and could make your offer more attractive. It tells real estate agents on the seller’s side, who work on commission, that negotiating with you could more likely pay off for them. In short, shopping with a mortgage loan pre-approval signals that you’re serious about buying a home.

Please apply by submitting an Online Loan Application or call 800-633-2848.

No. The credit bureau does not allow us to give out copies of the report. However, through NGFCU’s relationship with Balance – a non-profit dedicated to helping people and families achieve their financial dreams – you can request a Free Credit Report. You can also request a free copy of your credit report by visiting AnnualCreditReport.com.

Yes. Visit our Concierge Home Loan Service to see our First Trust Deed loan rates and to apply online.

When you’re ready to begin your home buying journey, please call us or submit an online application. To receive same day pre-approval and a pre-approval letter, we must have your completed application as well as any required documentation.

NGFCU offers the following loans: Auto, Home, Home Equity Line of Credit, Credit Cards, Personal Line of Credit, Personal Signature/Bill Consolidation, Recreational Vehicles, and Savings Secured Loans. Visit our Rates page to view current loan rates. Applying for a loan is easy. Just submit our secure Online Loan Application, or apply for a loan in-person at any NGFCU branch.

Applying for a loan is easy. Just submit our secure Online Loan Application. You can also apply for a loan in-person at any NGFCU branch.

Miscellaneous Questions

We do not accept payments for utility bills.

Yes, we offer business accounts for limited business types for existing members. Please contact us to determine if you qualify for business services at NGFCU.

You have several options for changing your address.

Branch – If you’re at a branch, a member service representative will help you change your address.

Online – Log in to NGFCU home banking and click on User Options in the top navigation bar. Choose Change Address in drop down menu and follow the prompts.

Mobile app – After using quick log in, click on the hamburger menu (three short lines) in the upper left corner of the screen and choose Settings. Enter your password. Choose Change Address. Make your changes and select Update in the upper right corner.

By mail – Members can use the Address Change Form and mail it to the Credit Union.

We do not sell savings bonds at NGFCU. However, we do redeem (cash) series EE bonds.

Yes, we offer notary services at most of our locations for both members and non-members. Notary services are by appointment only. Please contact the branch to schedule an appointment. Standard notary fees apply. See the current Schedule of Fees for additional information.

Yes. You will need to provide your employer with the account number and the percent of your payroll or specific dollar amount for each account into which you would like funds deposited.

Your money is insured by the National Credit Union Administration (NCUA), an independent agency of the United States Government. Your savings is federally insured up to $250,000 and backed by the full faith and credit of the United States Government.

A stop payment may be placed through online banking, by phone or in a branch. To place a stop payment, you will need to provide the check number, amount of the check and the name of the payee. A fee of $10.00 will be charged for each stop payment order. If a check has already been presented for payment to NGFCU, a stop payment order cannot be placed. To remove a stop payment, please contact the Credit Union at 800-633-2848.

Yes. Our Wire Transfer service allows members to transfer funds from an NGFCU account to an account at another financial institution located within the United States. You can transfer funds directly and securely, and the service is available at low fees. You’ll also receive confirmation once the funds have been sent to the other financial institution. The Credit Union does not offer international wire services.

No. However, we do offer official checks and cashier’s checks.

No, those under the age of 18 cannot apply for credit at NGFCU. However, we do offer debit cards for members 13 and over with the parents’ permission. Overdraft protection is also available subject to REG E. However, Courtesy Pay is not available on checking accounts for minors.

With the historic philosophy of “people helping people,” credit unions have existed to help people, not to make a profit. As such, earnings are returned to their members in the form of higher dividends on savings and low rate loans. Volunteer boards of directors, elected by the members, govern credit unions. With each vote, members have a direct impact on the administration of their credit union. A credit union's goal is to serve all of their members. Credit unions are owned by their members not by stockholders. Each member gets one vote and an equal say in how the credit union is run.

Visit our Careers page to learn about and apply for positions currently open at NGFCU.

Online Banking Questions

For the best online banking experience, please keep your computer software up-to-date and use the latest version of one of the browsers below:

- Windows: Chrome, Firefox, Microsoft Edge

- Mac: Safari, Chrome, Firefox

You can reset your password by clicking on “Forgot Password.”

You will need your person number and PIN. If you do not have your person number and PIN, please contact us at 800-633-2848.

Simply enter your User ID and password in the Online Banking Login at the top of this page.

Call 800-633-2848, 24 hours every day.

To take advantage of NGFCU online banking features and functions, you must first create your username and password. Just click the Register button on our Online Banking page and follow the simple instructions.

Security Questions

If your wallet has been lost or stolen, take the following actions:

- Call the three major credit reporting agencies (Equifax: 1-800-525-6285, Experian: 1-888-397-3742 and Trans Union: 1-800-680-7289) and ask them to immediately place a Fraud Alert on your name and Social Security number. The alert means any company that checks your credit knows your information was stolen and they have to contact you by phone to authorize new credit.

- Notify the SSN national fraud hotline at 1-800-269-0271.

- Cancel your credit cards by calling 800-633-2848.

- File a police report the same day, if at all possible, in the jurisdiction where your wallet was stolen.

If you are concerned that your financial information has been compromised, notify memberservices@ngfcu.us immediately.

If you feel you have been a victim of identity theft, contact the FTC’s Identity Theft Hotline toll-free at 1-877-IDTHEFT (438-4338); by mail: Identity Theft Clearinghouse, Federal Trade Commission, 600 Pennsylvania Avenue, NW, Washington, DC 20580; or visit IdentityTheft.gov.

Vishing is the telephone equivalent of phishing. Vishing is the act of using the telephone in an attempt to scam the user into surrendering private information that will be used for identity theft. The scammer usually pretends to be a legitimate business, and fools the victim into thinking he or she will profit. NGFCU will not send requests for this type of information by phone.

If you think you have been a victim of identity theft, visit IdentifyTheft.gov to see the specific steps to take to protect yourself.

Phishing is the act of sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft. The email directs the user to visit a website where they are asked to update personal information, such as passwords and credit card, social security, and account numbers that the legitimate organization already has. The website, however, is bogus and set up only to steal the user’s information. NGFCU will not send requests for this type of information via email.

If you think you have been a victim of identity theft, visit IdentifyTheft.gov to see the specific steps to take to protect yourself.